The cryptocurrency market is in chaos with high fall rates at the moment. The investors are in dilemma whether to hold out and wait for the bounce back or sell what they have and stop loss in time. The widespread crackdown on crypto trading by China seems to be catastrophic for the crypto market.

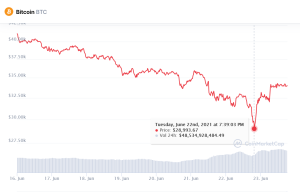

Even the leading cryptocurrency, Bitcoin suffered the hardest hit when it reached around $28,900 on Tuesday. Bitcoin dropped by more than 44% compared to an all-time high of $64,863 on April 14, 2021.

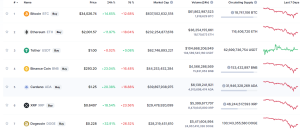

The impact also reflected on other cryptocurrencies including Ethereum, Dogecoin, and Cardano which shared the same fate. Over the last seven days, all of the top digital coins except Tether saw a decline in the market.

China’s Central bank urges to put a stop to cryptocurrency trading

The market crisis is more or less related to the announcement of China regarding cryptocurrency on Monday. The People’s Bank of China summoned several banks and payment firms including some major lenders like Alipay, Agricultural Bank of China, and Industrial and Commercial Bank of China. The central bank urged the lenders to halt the crypto-related services including clearing, trading, and settlements via cryptocurrencies.

According to the officials of Alipay, they will act as directed by the Central Bank and will not take part or support any virtual currencies. Furthermore, the company will manage to implement a monitoring system to supervise the transactions operating as per the policy.

Besides banning the crypto trade, Chinese officials shut down crypto-mining facilities in Sichuan on Sunday. Particularly, the facilities in Sichuan have high-tech computers that validate bitcoin transactions. The Sichuan Provincial Development and Reform Commission joined hands with Sichuan Energy Bureau on the crackdown. Reuters evidenced the notice issued by the agencies to close 26 potential crypto projects by Sunday. Mining projects of Xinjiang, Yunnan, and Inner Mongolia faced similar crackdowns recently.

As stated by the University of Cambridge, Sichuan lies in the second position in bitcoin mining activities in China. Based on the 2020 survey, the Bitcoin operations in China alone account for more than 75% of the global Bitcoin. It is estimated that more than 90% of the cryptocurrency projects of China have been shut down by now. Moreover, the robust programs from the Chinese government justify the current scenario of the crypto market crash on Tuesday.

Ruud Feltkamp, CEO at crypto trading bot Cryptohopper, described Bitcoin’s downfall as “People still react strongly to actions from China that create uncertainty, so this is likely to reflect negatively on the bitcoin price.”

Why China initiated the crackdown on cryptocurrency?

The Chinese government initiated the clampdown with concerns of environmental pollution and financial risks. Moreover, the crackdown targeted the dominant cryptocurrency, Bitcoin.

China is an ideal place for large volume mining due to cheap electricity resources. Many crypto mining hubs used electricity generated from coals which are considered the worst form of energy consumption. Despite using hydropower, the shutdown did not exclude Sichuan.

Energy consumption was indeed a reason why China pursued the crackdown. Even Elon Musk expressed worries about the dirty use of coal in mining Bitcoin. The tweets and the crackdown catalyzed the downward trend in the market.

Tesla & Bitcoin pic.twitter.com/YSswJmVZhP

— Elon Musk (@elonmusk) May 12, 2021

In addition, the Cabinet explicitly stated it cannot undermine the volatility of the crypto market. Furthermore, speculative crypto trading activities possess high risks to the financial order of the whole nation along with the economic condition of the individual citizens. In fact, China primarily started crypto regulation in 2017 which contributed to 80% market correction in the cryptocurrency that year. The tendency of China to reinforce the crackdown has created a stir in the market. The investors are pulling out of the cryptocurrencies questioning their sustainability.

However, one interesting fact has come to light regarding the crackdown. China is planning to come out with its own digital currency. Some experts criticized the crackdown and believe it was motivated by the same plan.

With leading cryptocurrencies out of the system, China’s own cryptocurrency will thrive in the monopoly market. While the ban is imposed on crypto transactions the consumers can still hold the cryptocurrencies.