Money is something we all have to deal with and struggle with all our lives. No matter how rich or poor you are, money is probably the most important things at this point.

There is nothing you can do if you don’t have money in your pockets. And society makes sure you know this every step of your life.

But why is something so important to us not taught to us from an early age?

When you think about it, we don’t have any knowledge about how to earn money and manage finances. We don’t really know what taxes are and how it works.

Don’t even get me started on capitals and mortgages; they’re out of my basic knowledge about finance. This means I don’t really know anything about it. Hence, I really do lack the knowledge of how to manage my money.

This isn’t just my problem alone. This is something all of us, especially people under 30 struggle with. And many-a-times even people above 50.

The real problem lies in how none of us are ever taught about financial literacy while in school.

The Actual Problem.

School education is the most fundamental thing we could get in our life. It is the foundation for our future.

Yet, it lacks in teaching us the very basic thing we deal with in the future, i.e. money.

The first and foremost thing or people to blame this on are the government and the school system.

The government determines the school curriculum and they make sure what to and what not to teach the young children.

And surprisingly financial literacy is left out from almost all the countries in the world.

There are a lot of reasons as to why the government omits teaching about money and finances at the school level.

For starters, money isn’t an easy thing to talk about, especially with a bunch of kids who only know money in the form of allowances.

It’s more of a complex subject matter to open up to school children. So, to educate them about finance is not impossible but extremely difficult.

Financial literacy isn’t so complicated; however, teaching the exponent is, that is actually 6th-grade math. But when money is involved, it takes a different turn.

Unknown Teachers and Parents.

In order to teach others something, we need to make sure that we’re well acquainted about the subject matter.

But when it comes to teaching financial literacy in schools, there aren’t enough qualified teachers.

We wrongly presume that school teachers are the most knowledgeable people around. When in reality, they’re also constantly learning and growing.

You can’t teach about money and finance to others when you yourself are so much under financial pressure.

When the teachers aren’t much of an expert about the subject, it makes it hard for them to teach the same thing to students.

But we can’t really blame them, can we? After all, they’re also a part of the same education system that we are.

So, it reverts back to the government who not only lacks in providing proper curriculum to the children but also proper training and education of the same.

And in the parent’s case, it’s their fundamental duty to teach their kids about saving and managing money.

If children grow up in a household where parents are really good with spending as well as saving money, they grow up to become better as well.

However, parents are really bad with their planning, spending, and investment habits; you can’t expect your children to do any better.

So, without proper guidance, you can’t expect a child to be better with money as soon as he grows up.

Changing System.

At this point, I’m sure a lot of us have acknowledged that the government is at fault for not including financial education in the school curriculum.

But now let’s put a little blame to the school system as well.

Ever since we start our school we’re always taught to study hard and get good grades.

In the past, it was all about competing with one another to get good grades followed by a better paying job.

You work hard all your lives for the same company till you retire. And as soon as you retire you get pension and boom! Your life is set.

But it doesn’t work that way in recent times. The system is all changed and so have the tax, pension, and legal systems.

So you can’t expect to retire and live a lavish life because you’ll get paid after you leave.

That is why it is very important to educate people about money and its importance from very early on.

Nobody knows where to start.

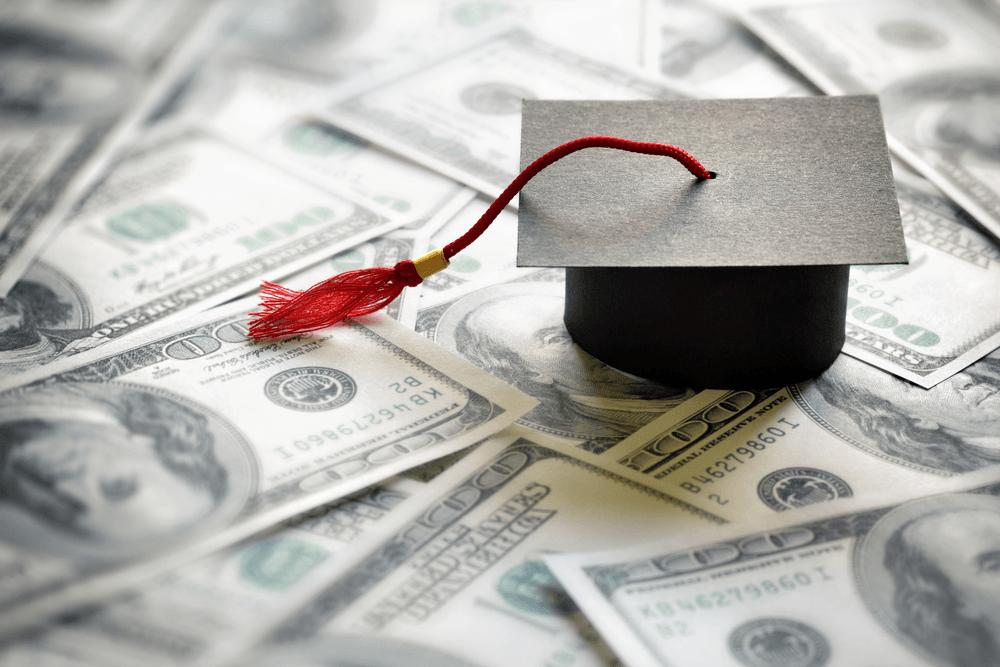

People might argue that you get to learn about money and finance in college. But, what about the people that don’t take finance as their major? Don’t they earn and need to manage their money?

So, it’s important to include financial education in the school curriculum.

Having said that, it’s not an easy thing to do, because quite frankly, nobody really knows where to start.

We all know the teaching methods and the curriculum is lacking. The monotonous teaching system makes learning dull and boring for both the teachers and students.

More importantly, the people who are the so-called experts in financial education think that no one is interested.

Why would knowing about how to earn and save money be boring you ask?

Well maybe because the youth of today have a different view of financing. The media has made such a negative impact on people that all they want to do is spend money beyond their capability and “flex”.

For them budgeting is boring, saving money translates to more restrictions and investing is only for rich people.

Financial education, like any other form of education, is needed to make people more aware. It is needed to make people more careful and aware of money and how it affects our lives.

But most importantly to make people be more in control of what happens and knowing exactly what to do if something goes wrong.